Welcome to the fifth and final post in our series on brand architecture models. This article will look at source and hybrid brand architecture models, specifically what they are and why they matter.

Did you miss the previous articles in this series? Check them out by visiting:

- Brand Architecture Models: An Introduction, Thoughts, and Perspectives

- The Branded House

- The House of Brands

- The Endorser Brand

What is a source brand architecture model?

The source brand model is similar to the endorser brand model, but there is one key difference. Like the endorser brand model, the source brand’s core company name is well-known and guarantees quality. Source brands, well-known as they may be, take a backseat position to their products, e.g., products are the heroes.

The core source brand and its product brands have unique but aligned positions. Each product name carries with it a single market positioning. That said, each new product brand and position are thematically aligned with the core source or parent brand and directly tie back to the parent (or source in this case) company’s brand essence, mission, and vibe.

Source brands are identified by:

- The source brand company name is well-known and guarantees quality

- The source brand company name takes a backseat position

- Products are the heroes

- Both the source brand and its product brands have unique but aligning positions

Some well-known examples of source brands include Apple, L’Oréal, and Nestlé.

How do source brand models differ from endorser brand models?

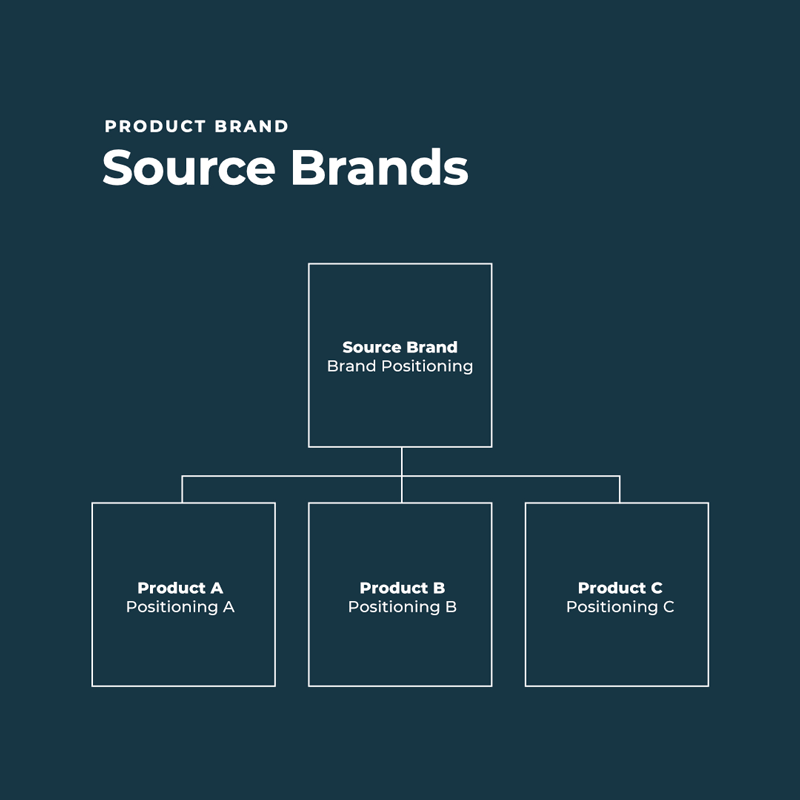

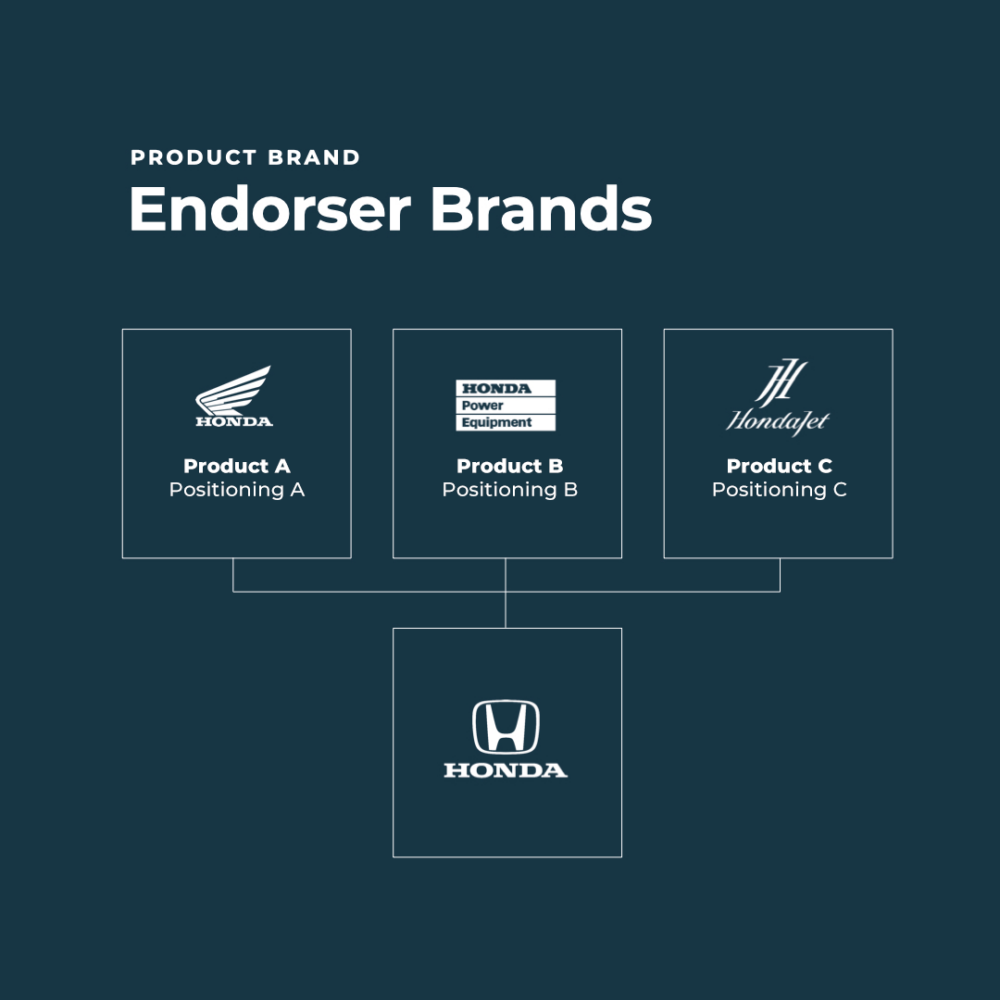

Looking at Diagram 1 (source-brand model), the boxes represent how individual product brands are interconnected, just like the endorser brand model shown in Diagram 3, an endorser brand model for Honda.

Note the linear connectors indicating a relationship between the source brand and its product lines. Unlike the example of the endorser brand, the source brand is positioned diagrammatically above its products as the sub-brands draw their initial brand equity from the parent source brand.

Apple’s source brand model

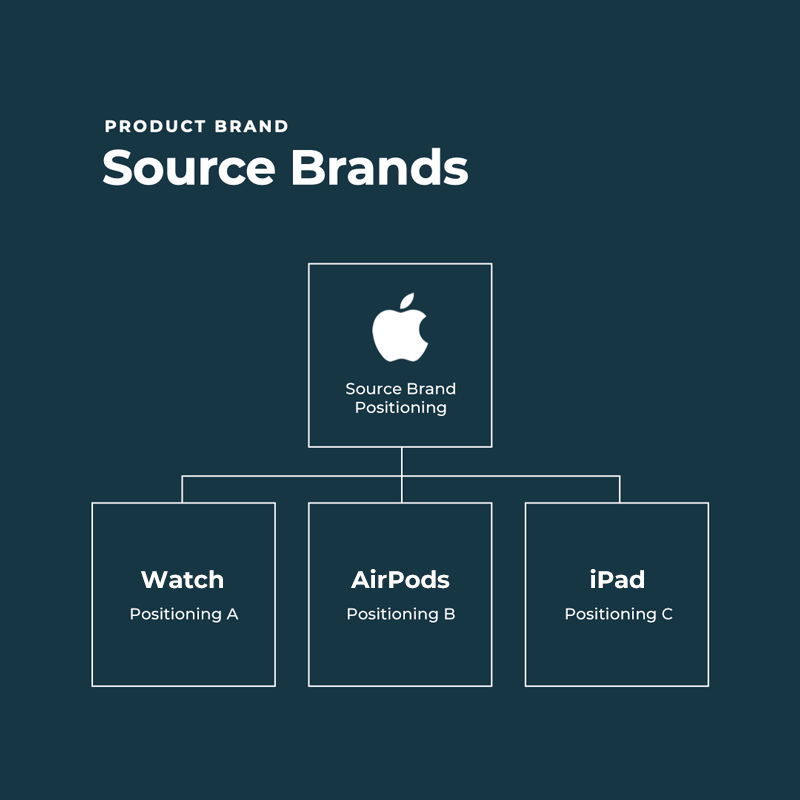

One of the most recognized examples of this framework is Apple. In Diagram 3, showing part of Apple’s source brand model, we see the primary Apple brand positioned above its product lines.

Endorser brand products rely heavily on their parent company’s foundation and good name (as shown in Diagram 2). Source brand products (as shown in Diagram 3) borrow heavily from their source brand’s equity and value propositions and often become formidable stand-alone brands—arguably a doubly powerful model over the endorser model.

Each brand position is distinct, representing a single product line and positioning, yet each is tied directly to the source brand. Unlike the source model, product line success within the endorser model largely depends on the support provided by the endorsing parent brand’s good name, core expertise, foundational practices, and market perceptions.

Why does the source brand architecture model matter?

Consider the Apple example again. Apple’s market cap recently eclipsed $3 trillion in 2023. Only six countries have a gross domestic product value of more than that. It’s no secret that Apple got there by strategically building the value of its source brand and sub-brands that captivate consumers.

Apple’s former CEO, Steve Jobs, was well-known for his highly-anticipated new product introductions. They were looked forward to because the world believed Apple to be a supremely innovative company producing superior experiences—and to view Jobs as a sort of real-life Willy Wonka.

In the eyes of the market, when Apple launched a product, it was sure to be ground-breaking, well-built, provide a transcendent experience, and become a coveted must-have for millions. Creating and maintaining deep brand value is a key to source brand success.

Source brand’s reputations precede them

Brands like L’Oréal, Nestlé, and Apple represent formidable source brand entrenchments. Their history as leading innovators and quality guarantors, as well as their ability to meet the expectations of loyal consumers, follows them every time they enter or reenter their respective markets.

Apple is largely known as a luxury brand, not a technology brand. When consumers buy their products, they identify themselves as a member of the Apple tribe—and are willing to pay a premium to be a part of the Apple family.

A brand perception that commands a higher price point bolsters the likelihood of success for both new production introductions and existing product lines.

“Without the brand, Apple would be dead. Absolutely. Completely. The brand is all they’ve got. The power of their branding is all that keeps them alive. It’s got nothing to do with products.”

Marc Gobe, author of Emotional Branding

WIRED, “Apple: It’s All About the Brand”

How to create a source brand

First and foremost, developing a sound and structured source brand architecture model requires strategic thinking, a focused approach, and time.

Here are a few tips to remember along the journey:

Consider your market

In our example, Apple promotes and perpetuates a relentless attraction to its brands and products among its most avid consumers. Those consumers, in turn, help advance that attraction by literally carrying the Apple brand everywhere they go, proudly announcing their brand allegiance to anyone and everyone around them.

All of this ever-advancing Apple brand equity helps create real and tangible market cap value and a clear and fertile business climate for Apple’s subbrands to flourish within.

Think about your products and their stand-alone audiences

Note that L’Oréal’s products—e.g., Paris, Lancôme, and Garnier—rarely, if ever, include a direct nod to the L’Oréal parent brand name. The same is true of Nestlé’s Nescafé, KitKat, and Nespresso products and Apple’s iPhone, Watch, MacBook Pro, and Airpod lines.

In each case, the products of these iconic source brands are borne and blessed by the parent brand but crafted to boast brand positions designed to uniquely capture the imagination of their target audiences. To stand alone and grow freely while enjoying the common brand family heritage.

On the other hand, endorser brands like Honda (Honda Jets, Honda Motorcycles, Honda Power Equipment, etc.) are far more directly tethered to the endorsing brand’s equities and values.

Protect and nurture your source company’s brand

Never lose sight of your source or parent brand’s connection and importance in the brand value mix. Products may be heroes, but they are made heroes by their parent brands. Wonka’s Everlasting Gobstopper candy was created in the imagination of Willy Wonka himself and set sail into the market from Wonka HQ. So it is with source/parent brands and their child brands.

Protect and nurture your source/parent brand’s sub-brands

The iPhone accounts for over half of Apple’s sales. Continued innovation and astute brand strategies and positioning are critical to the success of the iPhone’s stand-alone product line. It’s up to Apple to nurture and foster that at arm’s length just as much as it is the iPhone team’s responsibility to represent the Apple family and its collective brand values.

FAQs about the source brand model

Is the source brand model a viable business for your company?

The source brand model shares one thing in common with the endorser brand framework — a well-established parent brand equity. Source brands should be well-known, be highly regarded, and excel in one or many customer-valued dimensions in the markets and consumers they serve.

This helps ensure the initial success of the sub-brand products it spawns. But core brand alignment with consumers also bolsters the future growth, brand equities, and value of the child brands and parent brands alike.

If these dynamics exist in your entity, the source brand model is not only a viable framework but a formidable one.

What benefit is there in considering a source brand architecture model over other options?

In the end, any brand model can be successful given the right strategies, business infrastructures, consumer/product fit, and other factors we’ve covered throughout this series. But the source brand may present the most benefits of them all.

Take Nestlé, its name is synonymous with the word chocolate but at a deeper level, there’s that parent company guarantee of quality, innovation, and/or consistent experiences in making, drinking, and eating goods just for the pleasure of it. Nestlé’s product lines reciprocate in kind to their parent source brand every time they deliver on those brand promises.

But Nestlé’s product line brands possess their own distinct identities and the freedom to grow up and be profitable and powerful “adult” product brands within the Nestlé family. This value-elevating interplay between source and sub-brand can present a substantial advantage in the marketplace.

“Of all the things that your company owns, brands are far and away the most important and the toughest. Founders die. Factories burn down. Machinery wears out. Inventories get depleted. Technology becomes obsolete. Brand loyalty is the only sound foundation on which business leaders can build enduring, profitable growth.”

Jim Mullen, ad agency founder

Forbes

Final thoughts about the hybrid brand model

In summary, your brand architectural model should be tailored to your business and its goals. That can look different for every company. This series of articles was written to provide some commonly accepted models and frameworks you can use to begin assessing, modeling, and building your brand marketing framework. A roadmap, some guidance, and a starter kit as it were.

Often, you may find aspects of different models appealing and be tempted to combine them. A hybrid model describes that approach. The issue with hybrid models can be trying to build bifurcated or multi-layer strategies and complexities into what is already a potentially complex task: building a valuable brand.

Hybrid models can prove expedient in theory but can present confusion and consternation for your internal staff, investors, and, most importantly, your customers and consumers. Not to mention layers of cost or watered-down budgets ineffectively spread too thin across brands.

Remember to always map and plan first, think ahead, count the costs, and choose consumer-centric clarity over complexity.